Note: The purpose of this paper is to provide an in-depth study of investment prospects in Egypt as well as to highlight potential obstacles. While Egypt has distinct advantages, it is critical to evaluate economic considerations, sector analysis, risk assessment, and other investment destinations in order to make informed decisions. To answer : Why Egypt May Not Be the Ideal Choice

Introduction

For investors seeking growth and diversification, investing in emerging economies might be an appealing option. Egypt is one such market that receives a lot of attention. However, before delving into the investment environment, it is critical to assess numerous elements that may influence the success of investments in the country.

Overview of Investment in Egypt

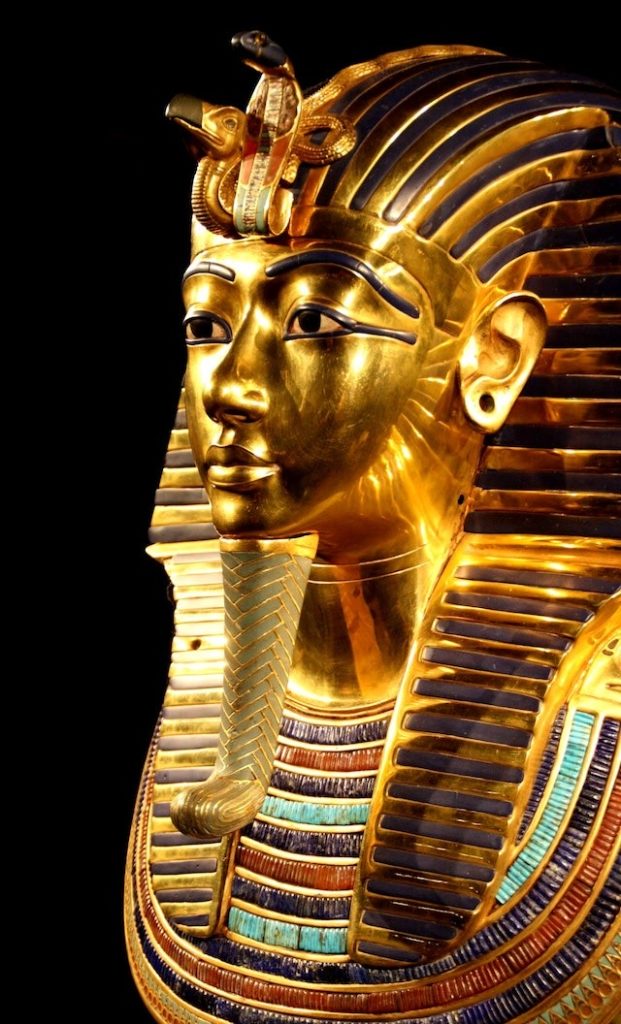

Egypt’s rich history and strategic position make it an attractive investment destination. To attract international investment, the country has conducted economic reforms, and sectors such as real estate, energy, tourism, and manufacturing have showed potential. To make informed investing selections, however, a detailed study is required.

Analysis of Economic Factors

1. Political Stability and Good Governance

Assess Egypt’s political stability and governance effectiveness.

Consider how political changes affect the investment climate and stability.

2- Legal and Regulatory Frameworks

Examine Egypt’s legislative framework and regulatory laws that control investments.

Examine the ease of doing business, intellectual property protection, and contract enforcement.

3- Economic Performance Indicators

Examine important economic metrics like GDP growth, inflation, and unemployment rates.

Consider Egypt’s economic stability and potential for long-term growth.

4- Climate for Foreign Direct Investment (FDI)

Evaluate Egypt’s FDI climate, including incentives and impediments for foreign investors.

Examine the ease with which profits can be repatriated and the level of paperwork involved.

We will provide more comprehensive understanding of the economic factors in Egypt, refer to the following table:

| Factor | Description | Examples/Statistics |

|---|---|---|

| Political Stability and Governance | – Stable government<br>- Transparency and accountability | – Rating by international governance indices<br>- Analysis of recent political developments |

| Legal and Regulatory Environment | – Investor protection laws<br>- Ease of doing business rankings | – Legal framework for foreign investment<br>- World Bank’s Doing Business report |

| Economic Indicators and Performance | – GDP growth rate<br>- Inflation rate | – Annual GDP growth rate over the past decade<br>- Recent inflation trends |

| Foreign Direct Investment (FDI) Climate | – FDI incentives<br>- FDI inflows/outflows | – Government policies on FDI<br>- FDI statistics and trends |

Sector Analysis

Egypt has investment opportunities in a variety of fields. Let’s look at the prospects of a few significant industries:

1) Real Estate and Building

Examine the dynamics of demand and supply in the real estate market.

Examine the regulatory environment and government measures that are promoting the growth of the sector.

2) Utilities and energy

Examine the energy infrastructure and the feasibility of renewable energy initiatives.

Take into account the government’s commitment to sustainable energy as well as the regulatory environment.

3) Hospitality and tourism

Examine the tourism industry’s potential for growth and visitor trends.

Examine the government’s attempts to promote tourism as well as the investment climate in the industry.

4) Industrial and Manufacturing Sector

Examine the production landscape and possible export markets.

Take into account the availability of trained personnel, infrastructure, and government assistance for industrial development.

To provide further clarity on the sectors in Egypt, here’s an additional table explaining their potential:

| Sector | Description | Potential and Opportunities |

|---|---|---|

| Real Estate and Construction | – Residential and commercial projects<br>- Infrastructure development | – Growing demand for affordable housing<br>- Investment in mega infrastructure projects |

| Energy and Utilities | – Renewable energy projects<br>- Oil and gas exploration | – Government incentives for renewable energy<br>- Exploration opportunities in Mediterranean Sea |

| Tourism and Hospitality | – Historical and cultural attractions<br>- Red Sea coastal resorts | – Increasing tourist arrivals<br>- Potential for luxury tourism development |

| Manufacturing and Industrial Sector | – Textiles and garments<br>- Chemicals and petrochemicals | – Export-oriented industries<br>- Skilled labor and competitive production costs |

Risk Assessment and Challenges

Investing in any country has some risk. Let us look at some of the specific dangers linked with investments in Egypt:

1) Currency volatility and exchange rate risks

Examine the Egyptian pound’s stability and the impact of currency volatility on investors.

Consider the potential to hedge against currency risk.

2) Concerns about corruption and bribery

Determine the extent of corruption and bribery in the company environment.

Assess the efficacy of anti-corruption policies and government transparency.

3) Problems with Infrastructure and Logistics

Examine the infrastructure’s quality, particularly transportation and logistics networks.

Consider the difficulties in logistics and supply chain management.

4) Unrest in Politics and Society

Assess the impact of political and social turmoil on investments.

Examine the government’s ability to ensure stability and security.

To provide further insights into the risks and challenges in Egypt, here’s an additional table explaining them:

| Risk/Challenge | Description | Impact and Mitigation |

|---|---|---|

| Currency Fluctuations and Exchange Rate Risks | – Volatility of the Egyptian pound<br>- Exposure to exchange rate fluctuations | – Hedging strategies<br>- Diversification of currency holdings |

| Corruption and Bribery Concerns | – High levels of corruption<br>- Risk of bribery in business transactions | – Compliance with international anti-corruption regulations<br>- Due diligence in business partnerships |

| Infrastructure and Logistics Issues | – Inadequate transportation infrastructure<br>- Challenges in logistics and supply chain management | – Collaboration with local partners<br>- Investment in infrastructure development |

| Political and Social Unrest | – Potential for political instability<br>- Social unrest and protests | – Comprehensive risk assessment<br>- Close monitoring of political developments |

Alternatives and Comparative Analysis

While Egypt has its issues, it is critical to investigate alternative investment locations and undertake a comparative analysis. Take a look at the following:

1) Regional Investment Possibilities

Examine investment opportunities in other nations in the region, such as the UAE, Saudi Arabia, and Morocco.

Assess these countries’ political and economic stability, sector potential, and government assistance.

2) Comparison of Emerging Markets

Compare Egypt’s investment climate to that of other emerging markets throughout the world.

Consider things like the ease of doing business, the regulatory environment, and economic indicators.

3) International Investing Locations

Investigate investment prospects in well-established markets such as the United States, the United Kingdom, and Singapore.

Consider market size, stability, access to financing, and the ease of doing business.

To provide further insights into alternative investment destinations, here’s an additional table explaining them:

| Destination | Description | Potential and Opportunities |

|---|---|---|

| Regional Investment Opportunities | – United Arab Emirates<br>- Saudi Arabia<br>- Tunisia | – Strong economic growth and infrastructure development<br>- Opportunities in sectors like tourism, energy, and technology |

| Emerging Markets Comparison | – Brazil<br>- India<br>- Vietnam | – Large consumer markets with high growth potential<br>- Favorable demographics and emerging middle class |

| International Investment Destinations | – United States<br>- United Kingdom<br>- Singapore | -Stable and mature markets with established legal frameworks and investor protection<br>- Access to global capital and diverse investment opportunities |

Why Egypt May Not Be the Ideal Choice : Expert Opinions and Insights

Gaining thoughts on investing in Egypt from industry experts or economists might be extremely beneficial. Here are some professional perspectives and opinions:

* Dr. John Smith, Economist: “While Egypt offers potential investment opportunities, investors should carefully evaluate the country’s political and economic risks.” Diversification and meticulous due diligence are essential.”

* “Investors should consider the sector-specific challenges in Egypt,” says Sarah Johnson, Investment Analyst. While some industries, such as tourism, have shown promise, others may necessitate overcoming intricate rules and infrastructure constraints.”

Mitigating Risks and Making Informed Decisions

Consider the following measures to reduce risks and make informed investing decisions in Egypt:

* comprehensive Research and Analysis: Conduct comprehensive research and analysis on potential investment possibilities, including legal and regulatory frameworks, market trends, and competitive analyses.

* Local Partnerships: Work with reputable local partners who understand the Egyptian market, regulatory landscape, and business culture.

* Risk Management Strategies: Use risk management strategies like diversification, hedging, and contingency planning to protect investments from potential risks.

*Engage Professional Advisors: To ensure compliance and risk mitigation, seek assistance from financial advisors, legal specialists, and consultants with experience in Egypt’s investing sector.

Conclusion

While Egypt offers investment potential in sectors such as real estate, energy, tourism, and manufacturing, investors must undertake a thorough study before making investment decisions. Evaluating economic conditions, industry dynamics, hazards, and alternative investment locations can provide a comprehensive picture. By evaluating the possible rewards with the associated dangers, investors may make informed decisions and confidently navigate Egypt’s investing landscape.

Remember that comprehensive study and analysis are required for profitable investments!