Entrepreneurship requires more than just a brilliant business idea and the will to succeed. To launch and grow a successful business, entrepreneurs need to have a solid financial plan in place. Financial planning is an essential aspect of entrepreneurship that enables business owners to make informed decisions, manage risks, and achieve long-term goals. In this article, we will discuss the importance of financial planning for entrepreneurs, with a focus on the topic of “Financial Planning for Entrepreneurs.” We will explore key concepts, strategies, and tools that entrepreneurs can use to start and grow their businesses while making sound financial decisions. Whether you are a seasoned entrepreneur or just starting your journey, this article will provide valuable insights and actionable advice to help you achieve financial success.

The Importance of Financial Planning for Entrepreneurs

Financial planning is a critical component of entrepreneurship. Entrepreneurs who do not prioritize financial planning in their business strategy may find it difficult to manage their cash flow, make informed decisions, and achieve their long-term goals. In this section, we will discuss the importance of financial planning for entrepreneurs, explaining its role in starting and growing a successful business.

the role of financial planning in entrepreneurship

Financial planning plays a vital role in entrepreneurship. It enables business owners to understand their financial situation and develop strategies to manage their finances effectively. Financial planning involves the creation of a detailed budget that outlines all the expenses and revenues of the business. This budget serves as a roadmap for the business owner, guiding them on how to allocate resources and prioritize spending.

In addition to budgeting, financial planning also involves forecasting future revenues and expenses. By forecasting, business owners can anticipate potential challenges and opportunities, enabling them to make informed decisions. This forecasting process includes creating financial projections, analyzing cash flow, and conducting sensitivity analysis.

financial planning is essential for starting and growing a business

Financial planning is essential for starting and growing a business. It helps entrepreneurs to make informed decisions and allocate resources effectively. Without a sound financial plan, entrepreneurs may struggle to secure funding, manage cash flow, and identify growth opportunities.

For example, an entrepreneur who fails to plan for unexpected expenses may struggle to meet their financial obligations. This can lead to cash flow problems that can prevent the business from operating efficiently. On the other hand, entrepreneurs who have a solid financial plan in place can identify potential challenges and take steps to mitigate them, such as by reducing expenses or increasing revenue streams.

Furthermore, financial planning is essential for securing funding. Investors and lenders often require entrepreneurs to provide a detailed financial plan that outlines their revenue and expense projections. This information helps investors and lenders assess the viability of the business and determine the level of risk associated with investing in it.

Furthermore, financial planning is essential for securing funding. Investors and lenders often require entrepreneurs to provide a detailed financial plan that outlines their revenue and expense projections. This information helps investors and lenders assess the viability of the business and determine the level of risk associated with investing in it.

examples of successful businesses that have implemented effective financial planning

Many successful businesses have implemented effective financial planning strategies that have helped them to achieve their goals. One example is Apple Inc., which is known for its financial discipline and strategic planning. Apple’s financial planning involves a focus on long-term goals, with the company investing heavily in research and development to create innovative products and services.

Another example is Amazon.com, which has been able to achieve significant growth through effective financial planning. Amazon’s financial planning involves a focus on efficiency, with the company constantly seeking ways to reduce costs and increase revenue streams. This has enabled Amazon to expand into new markets and diversify its product offerings, while maintaining profitability.

Key Concepts in Financial Planning for Entrepreneurs

There are several key concepts that entrepreneurs must grasp and apply to their businesses when it comes to financial planning. In this part, we’ll delve deeper into some of these ideas, such as cash flow, budgeting, and forecasting, and provide real-world examples of how successful entrepreneurs have used them to achieve financial success.

Cash Flow

- One of the most critical financial concepts for entrepreneurs to understand is cash flow. Cash flow refers to the amount of cash coming in and going out of a business over a specific period. It’s essential to have a positive cash flow to ensure that the business can pay its bills, invest in growth, and withstand unexpected events.

To manage cash flow effectively, entrepreneurs need to track their income and expenses, review their financial statements regularly, and plan for seasonal fluctuations or other changes in cash flow. By doing so, they can make informed decisions about how to allocate their resources and avoid running into cash flow problems down the road.

A real-world example of an entrepreneur who has successfully managed their cash flow is Sam Ovens, founder of Consulting.com. He started his business with just $10,000 in savings but quickly grew it into a multi-million dollar company. One of the keys to his success was his careful management of cash flow. He tracked every penny coming in and going out of the business and made sure to keep a healthy buffer of cash on hand to weather any storms.

A real-world example of an entrepreneur who has successfully managed their cash flow is Sam Ovens, founder of Consulting.com. He started his business with just $10,000 in savings but quickly grew it into a multi-million dollar company. One of the keys to his success was his careful management of cash flow. He tracked every penny coming in and going out of the business and made sure to keep a healthy buffer of cash on hand to weather any storms.

Budgeting

Budgeting is another important financial idea for entrepreneurs. A budget is a financial plan that details a company’s expected income and expenses for a given time frame. It’s a tool that can assist entrepreneurs in making better financial decisions, prioritizing spending, and staying on schedule to meet long-term objectives.

To establish an effective budget, entrepreneurs must first grasp their company’s financial situation and goals. They must determine their revenue sources, fixed and variable expenses, as well as any possible risks or opportunities. They can then construct a budget that reflects their company’s needs and ensures they have the resources to meet their objectives.

A real-world example of an entrepreneur who has effectively used budgeting to grow their business is Pat Flynn, founder of Smart Passive Income. He created a detailed budget for his business early on and used it to track his income and expenses. This helped him identify areas where he could reduce costs, reinvest in growth, and increase his profits.

Forecasting

real-world example of an entrepreneur who has effectively used forecasting to grow their business is Nathan Latka, founder of Heyo. He used forecasting to predict his business’s future revenue and expenses and identified the key drivers of growth. By doing so, he was able to make informed decisions about where to allocate his resources and achieve rapid growth.

A real-world example of an entrepreneur who has effectively used forecasting to grow their business is Nathan Latka, founder of Heyo. He used forecasting to predict his business’s future revenue and expenses and identified the key drivers of growth. By doing so, he was able to make informed decisions about where to allocate his resources and achieve rapid growth.

A real-world example of an entrepreneur who has effectively used forecasting to grow their business is Nathan Latka, founder of Heyo. He used forecasting to predict his business’s future revenue and expenses and identified the key drivers of growth. By doing so, he was able to make informed decisions about where to allocate his resources and achieve rapid growth.

Strategies for Successful Financial Planning

Financial planning is a key aspect of entrepreneurship that can help business owners make informed decisions and achieve their long-term goals. Effective financial planning strategies are critical to the success of any business. In this section, we will outline some of the most effective financial planning strategies that entrepreneurs can use to start and grow their businesses.

Create a Financial Plan

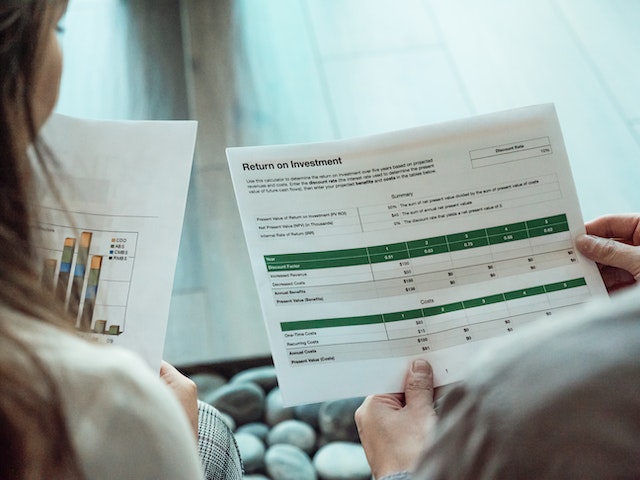

The first and most important financial planning strategy for entrepreneurs is to create a comprehensive financial plan. A financial plan is a roadmap that outlines your business’s financial goals, objectives, and strategies for achieving them. It should include a cash flow forecast, balance sheet, income statement, and other financial statements.

To create an effective financial plan, entrepreneurs should identify their business goals and objectives, assess their current financial situation, and develop a realistic budget. They should also consider their financial risks and develop contingency plans to address them. A financial plan should be regularly reviewed and updated as business conditions change.

Monitor Cash Flow

Cash flow is the lifeblood of any business. Monitoring cash flow is a critical financial planning strategy that entrepreneurs must follow to ensure their businesses’ long-term viability. A cash flow statement is a crucial tool that provides an overview of the inflows and outflows of cash in a business.

Entrepreneurs should regularly review their cash flow statements and identify areas where cash flow can be improved. They should also maintain a cash reserve to address unforeseen expenses and emergencies. By monitoring cash flow, entrepreneurs can avoid cash flow crises and keep their businesses running smoothly.

Reduce Expenses

Another effective financial planning strategy for entrepreneurs is to reduce expenses. By reducing expenses, entrepreneurs can improve their cash flow, increase profitability, and reinvest the savings into their businesses.

Entrepreneurs should regularly review their expenses and identify areas where they can cut costs without compromising the quality of their products or services. They can negotiate with suppliers, reduce inventory, or outsource non-core activities to save money. Entrepreneurs can also explore new ways to generate revenue, such as offering new products or services or entering new markets.

Real-life Case Studies

Successful entrepreneurs have implemented various financial planning strategies to grow their businesses. For example, Warren Buffett, one of the most successful investors of all time, has emphasized the importance of creating a financial plan and monitoring cash flow. He once said, “Someone’s sitting in the shade today because someone planted a tree a long time ago.”

Another example is Jack Ma, the founder of Alibaba, who emphasized the importance of reducing expenses in the early stages of his business. He once said, “I think we have to keep a very low profile. We have to act like a small company. And we have to control the costs.” By reducing expenses, Jack Ma was able to keep his business lean and agile, which allowed him to quickly respond to changing market conditions.

Tools for Financial Planning for Entrepreneurs

Financial planning can be a complex process that involves managing budgets, cash flow, forecasting, and more. Fortunately, there are various tools and technology available that can make the process much easier and efficient. In this section, we will explore the importance of using tools and technology to aid in financial planning for entrepreneurs and discuss some popular financial planning tools.

The Importance of Using Tools and Technology to Aid in Financial Planning

Entrepreneurs no longer have to depend on manual bookkeeping and paper-based financial statements to manage their finances. There are numerous financial planning tools accessible today that can help entrepreneurs make informed decisions and streamline financial management. Entrepreneurs can use these tools to reduce the risk of errors, save time, and make more accurate financial forecasts.

Furthermore, using financial planning tools can help entrepreneurs keep track of their finances in real-time, allowing them to respond swiftly to market or economic changes. This is especially critical for startups and small businesses, which are more susceptible to financial insecurity. Entrepreneurs can make better choices and position themselves for success if they have access to up-to-date financial information.

Accounting software

Accounting software is an essential tool for entrepreneurs who want to manage their finances efficiently. With accounting software, entrepreneurs can track their income and expenses, generate financial statements, and reconcile bank accounts. Some popular accounting software options for small businesses include QuickBooks, Xero, and FreshBooks. These tools also offer additional features such as invoicing, payroll, and tax preparation.

Budgeting app

Budgeting apps are another valuable tool for entrepreneurs who want to keep their finances organized. These apps allow entrepreneurs to create and monitor budgets, track expenses, and set financial goals. Some popular budgeting apps include Mint, You Need a Budget (YNAB), and PocketGuard. These tools can help entrepreneurs identify areas where they can cut costs and make informed decisions about their spending.

Forcasting tools

Forecasting tools are designed to help entrepreneurs predict their financial performance in the future. By analyzing historical data and trends, these tools can generate financial projections and scenarios. Some popular forecasting tools for small businesses include PlanGuru, Prophix, and Adaptive Insights. These tools can be particularly useful for startups that need to raise capital or make strategic decisions about future investments.

Financial planning is an important element of business that entrepreneurs should not overlook. Starting and growing a company necessitates careful financial planning and management, and using the right tools can make the process much more efficient and effective. In this article, we discussed the significance of financial planning, the various kinds of financial plans, and the tools that entrepreneurs can use to effectively manage their finances. These tools can assist entrepreneurs in making informed choices and staying on top of their finances, from budgeting to forecasting future financial success.

By incorporating financial planning into their business strategies, entrepreneurs can position themselves for long-term success and growth. It is essential to choose the right tools and use them effectively to reap the benefits of financial planning, and entrepreneurs should continually assess their financial situation to adjust their plans accordingly. With the right mindset, tools, and strategies in place, entrepreneurs can achieve their financial goals and build successful businesses.

Pingback: Building A Diversified Investment Portfolio: Tips And Strategies : Invest For Fun 2023